Have you ever heard of compound interest? It’s like a secret ingredient that can turn small amounts of money into big savings over time. Imagine your money growing on its own, even while you sleep. That’s the power of compound interest. In this article, we’ll take a closer look at what compound interest is, how it works, and most importantly, why getting started early can make a huge difference for your financial future.

- What is Compound Interest?

- How Does It Work?

- Why Starting Early Matters

- An Example of It

- Practical Tips for Harnessing Compound Interest

What is Compound Interest?

Let’s start with the basics. Compound interest is the concept of earning interest not only on the money you put in but also on the interest that money earns over time. It’s like a snowball effect—your savings grow bigger and bigger as time goes on. Instead of just adding interest to your initial investment, compound interest adds interest to the interest, creating exponential growth.

source: https://www.stlouisfed.org/open-vault/2018/september/how-compound-interest-works

How Does It Work?

To understand compound interest better, let’s look at an example. Imagine you have $1000 in a savings account that offers a 5% interest rate annually. At the end of the first year, you’ll earn $50 in interest, bringing your total to $1050. Now, in the second year, you won’t just earn 5% interest on your initial $1000—you’ll earn it on the new total of $1050. So, you’ll earn $52.5 in interest this time. Your total balance grows to $1102.50 As you can see, your money is working harder for you each year, thanks to compound interest.

Why Starting Early Matters

Now, here’s where things get really interesting. The most significant advantage of compound interest is time. The earlier you start saving, the more time your money has to grow. Even if you can only put in a small amount of money at first, it can turn into a substantial sum over time thanks to compound interest. This is why financial experts often stress the importance of starting to save and invest as early as possible.

An Example

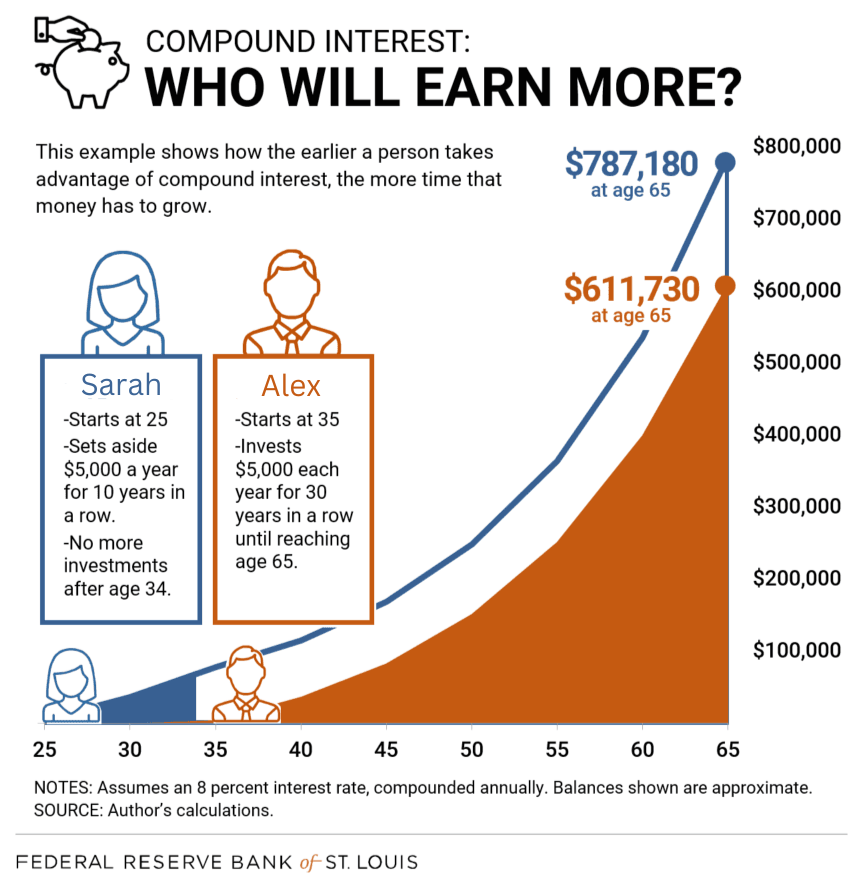

Let’s illustrate the power of compound interest with a hypothetical scenario. Suppose you have two friends, Alex and Sarah. Sarah starts saving $5000 a year when she’s 25 years old, and she continues to do so until she’s 35. Over those ten years, she contributes a total of $50.000. Now, let’s say Alex decides to wait until he’s 35 to start saving. He also puts away $5000 a year, but he does it for 30 years, contributing a total of $150.000 . Who do you think will end up with more money in the end?

Surprisingly, it’s Sarah. Even though she contributed less money overall, her savings had more time to grow thanks to compound interest. By the time they both turn 65, Sarah´s investment could grow to over $787.000 , assuming a 8% annual return. Alex, on the other hand, might end up with around $610.000 . This shows just how powerful starting early can be when it comes to saving for the future.

source: https://www.stlouisfed.org/open-vault/2018/september/how-compound-interest-works

Practical Tips for Harnessing Compound Interest

Now that you understand the importance of compound interest, let’s talk about how you can make the most of it:

- Start Now: Whether you’re in your twenties or your fifties, the best time to start saving and investing is now. Every day you delay means less time for compound interest to work its magic.

- Be Consistent: Regular contributions, even if they’re small, can add up over time. Set up automatic transfers from your paycheck or bank account to make saving easier.

- Stay Patient: Compound interest is a long-term game. Don’t get discouraged if you don’t see massive returns right away. Stay focused on your goals, and trust that your money will grow over time.

- Maximize Returns: Look for investment opportunities that offer compound interest, such as stocks or mutual funds. The higher the interest rate, the faster your money will grow.

- Avoid Debt: Compound interest can work against you if you’re carrying high-interest debt. Prioritize paying off debts like credit cards and loans to free up more money for saving and investing.

Conclusion

Compound interest is like a superpower for your savings. It has the potential to turn small contributions into significant sums of money over time. By understanding how compound interest works and starting to save and invest early, you can set yourself up for a secure financial future. So, don’t wait—start harnessing the power of compound interest today and watch your money grow exponentially over time. Your future self will thank you for it!