If you had discovered this Blog 2 years ago, you would probably have been able to save €15,000, of course it depends on the amount of your monthly savings plan, it would probably be much more 😉

Let’s start slowly, what is this blog about?

Experience

My entire blog is based on a personal basis and so I don’t hide anything, I just want to pass on the knowledge I’ve learned and if I can help someone with it, it’s worth a lot to me.

When I turned 18, I entered the stock market ignorantly and naively and therefore didn’t make the best investments. They were very risky investments that could quickly go wrong, but I was a little lucky and didn’t burn myself too badly.

I see individual stocks as risky investments. Of course there are lucky breaks if you correctly assess the market when there are fresh news and know which companies to invest in, but to do this you have to be permanently active in the market and set fixed buy/sell points. As far as “trading” goes, we don’t want to go in that direction. We want to make safe, long-term investments and let our money work passively.

For this reason, I left my old “quick money” mindset behind and looked for usefull, long-term Investments.

And so we come to Funds and ETFs

What are Funds/ETFs?

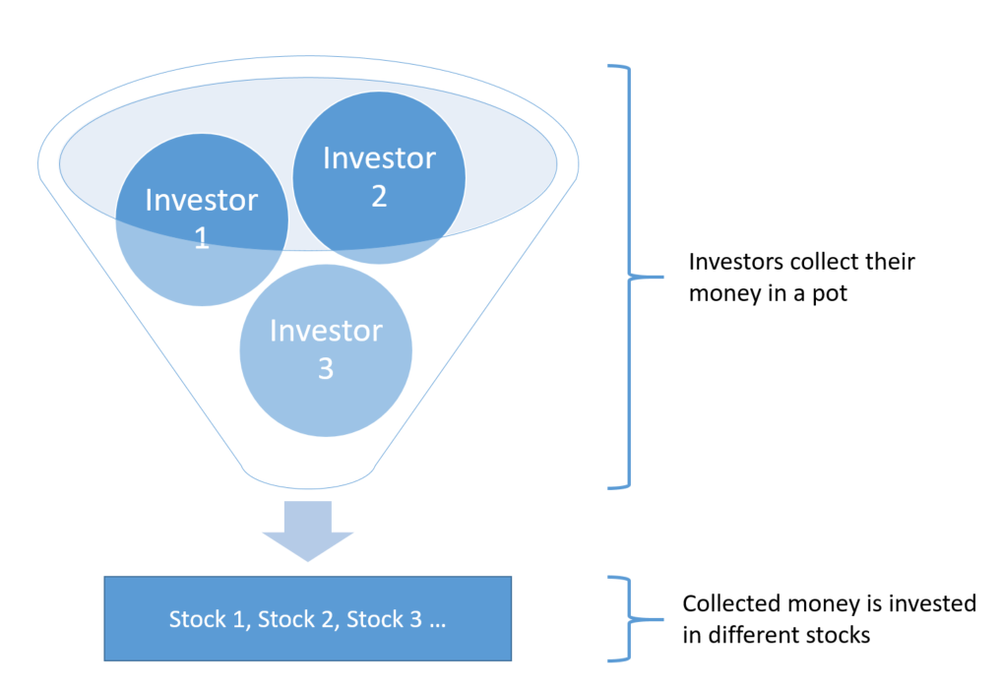

Source: https://lazy-investing.com/blog/2022/03/25/etf-savings-plan/

ETF: Exchange Traded Funds

Several selected company stocks are thrown into one pot, giving you a better spread of risk than individual stocks. If the company of an individual share goes bankrupt, this share is no longer worth anything, but if this company goes bankrupt in an ETF or Fund, the value of your ETF/Fund drops slightly (depends on what percentage share this company has in your ETF/Fund) .

Example of the diversification of a fund

Who controls ETFs/funds?

ETF: are computer-controlled.

Fund: Fund managers taking care of the selection and trading of the stocks

Which ETFs/Funds exist?

There is currently a huge selection, whether country-specific, industry-specific or the entire global economy. I’ll tell you later which ETFs I use.

Which Broker? And why do I need one?

As a private individual, you cannot simply buy shares or ETF/Fund shares from companies, so you are dependent on a “broker”, a broker is a “middleman”

Is my money safe with an “broker”?

As long as you invest your money with a known and secured broker and not with your friend from the back yard, your money is safe.

For example: The invested money at the Broker “Scalable Capital” are held by Baader Bank and are therefore protected by the German deposit insurance of 100,000 euros.

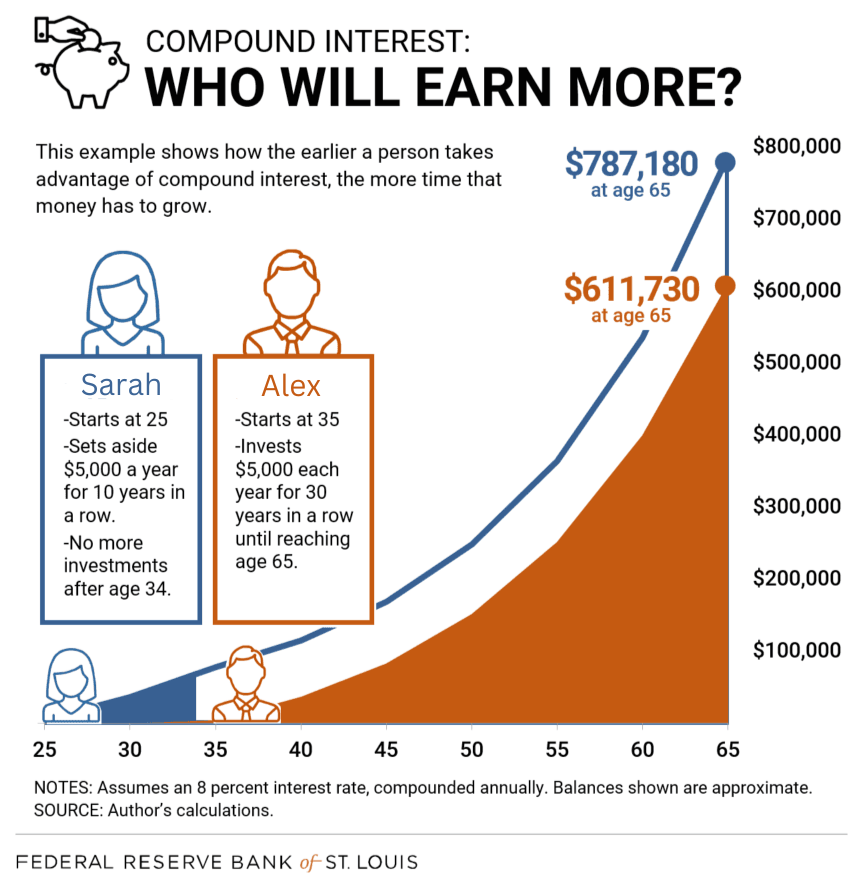

Invest as soon as possible to have a bright future!

The Diagram below shows the Compound Interest Effect, if you wanna read more about it click here.

source: https://www.stlouisfed.org/open-vault/2018/september/how-compound-interest-works

We tried 2 different Fond´s for you! The Results are Insane!

We tried 2 different etf´s for some months for this blog and we achieved in average around 17% Profit

For a good end and a proof for this Blog i will show you my Depot

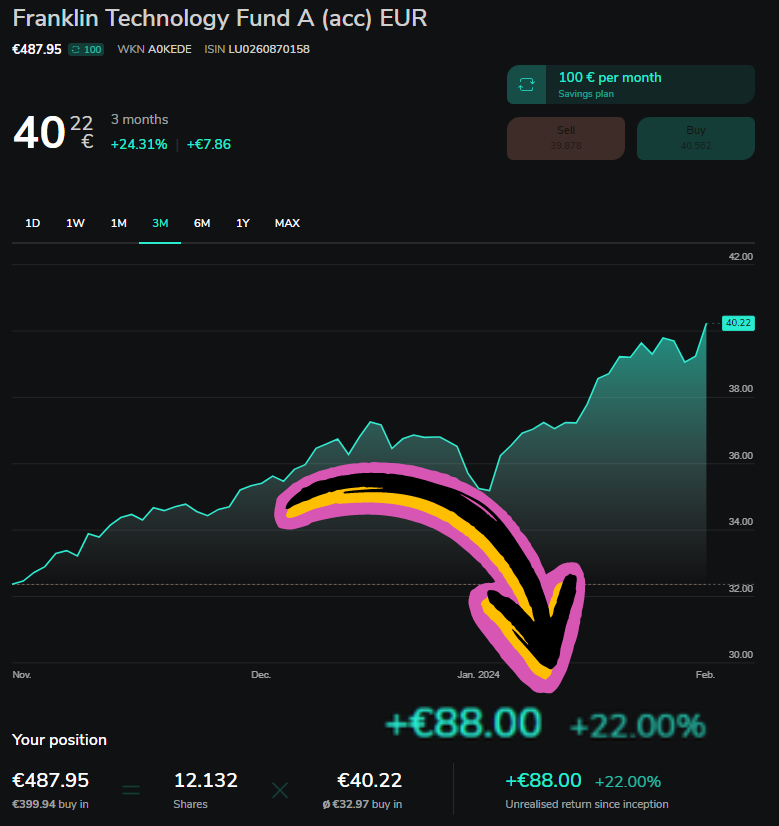

Franklin Technology Fund

I have tried this one as my new fund because i wanted to go into the Tech Branche, and the results are insane! i invested for 4 Months 100€ monthly till now and achieved 22% Profit in that little amount of time!

ofcourse it doesn´t have to be everytime like this because the market always goes down or up, so in the end what matters is how your fund looks like after a long time.

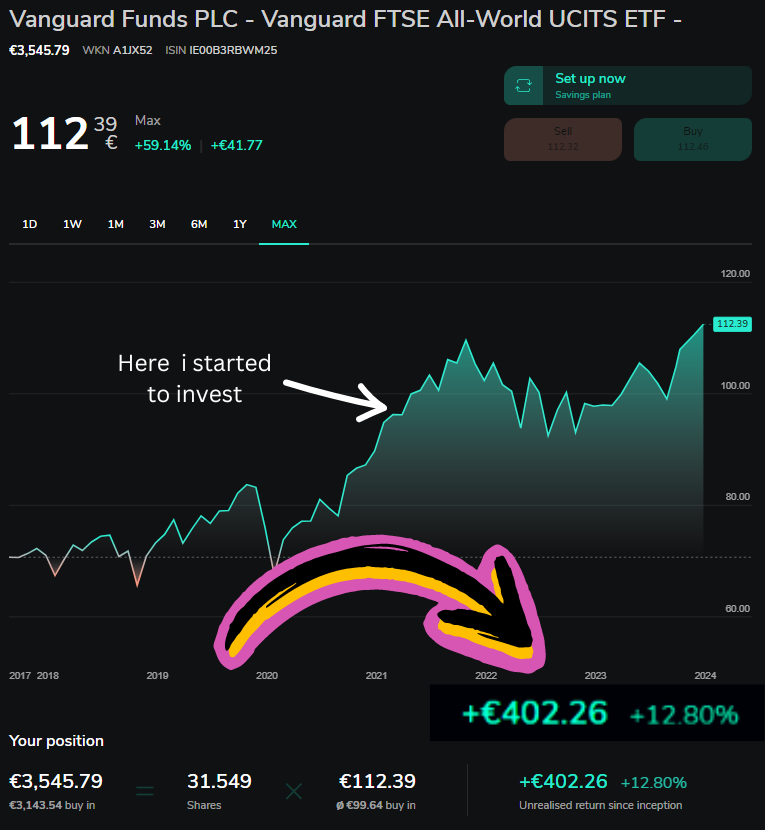

Vanguard Fund

in this Fund i were investing 125€ monthly since summer 21´ till summer 23´ and rounded up 13% average interest are also very good results