Introduction to Psychology of Investing

Investing can be both exciting and daunting. While it offers the potential for financial growth, it also presents psychological challenges that can affect decision-making. Understanding the psychology behind investing is crucial for navigating the ups and downs of the market effectively. In this blog post, we’ll explore the psychological aspects of investing, delve into common challenges that investors face, and provide practical tips for overcoming these obstacles.

What is this Blog about?

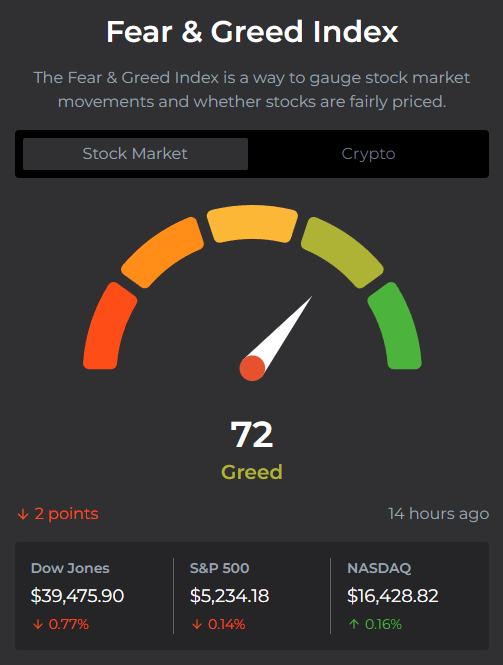

You can check the current market situation here.

The Psychology of Investing

Investing isn’t just about numbers and charts—it’s also about human behavior. Our emotions, biases, and cognitive tendencies play a significant role in how we approach investment decisions. Let’s take a closer look at some psychological factors that can influence investors:

Fear and Greed: Fear of losing money and greed for higher returns are two powerful emotions that can drive investment decisions. During market downturns, fear may lead investors to panic sell, while greed can cause them to chase high-risk investments without proper consideration.

Confirmation Bias: Investors tend to seek out information that confirms their existing beliefs and ignore evidence that contradicts them. This can lead to a narrow-minded approach to investing and a reluctance to consider alternative viewpoints.

Herd Mentality: Humans have a tendency to follow the crowd, especially in uncertain situations. This herd mentality can lead to exaggerated market movements and asset bubbles as investors flock to popular trends without conducting thorough research.

Fear&Greed

The Fear & Greed Index is a great example of the recurring cycle of the stock market.

When the market drops down, instead of thinking to invest and getting a nice price, most beginners just Fear and thinking “this is all bullshit, i should´ve never invested” and at this point they´re selling, at the worst price they could get.

You should learn to control your thoughts when investing and realistically assess when you should buy and when you should sell.

Tips for Overcoming Psychological Challenges

Stay Informed: Educate yourself about investing principles, market dynamics, and the impact of psychology on investment decisions. Knowledge is your best defense against irrational behavior.

Create a Plan: Develop a well-defined investment plan with clear goals, risk tolerance, and a diversified portfolio strategy. Having a plan in place can help you stay focused and avoid impulsive decisions.

Practice Discipline: Stick to your investment plan and avoid making emotional decisions based on short-term market fluctuations. Remember that investing is a long-term endeavor, and patience is key to success.

Seek Perspective: Surround yourself with trusted advisors who can provide objective insights and help you avoid succumbing to herd mentality or confirmation bias.

Embrace Diversification: Diversify your investment portfolio across different asset classes, industries, and geographic regions to spread risk and minimize the impact of individual market movements.

Conclusion

Investing is as much about psychology as it is about numbers. By understanding the psychological factors that influence investment decisions and implementing strategies to overcome common challenges, you can become a more confident and resilient investor. Remember to stay informed, disciplined, and focused on your long-term goals, and you’ll be better equipped to navigate the complexities of the financial markets.